"Royal Dutch Shell, the Anglo-Dutch oil and gas producer, said Friday that it had struck a deal to buy most of the assets of East Resources for $4.7 billion in cash, moving into the coveted sector of natural gas contained in shale deposits.

The Shell deal is with East Resources, an independent oil and gas company, its private equity backer Kohlberg Kravis Roberts and its financial adviser Jefferies.

“The opportunity now is to consolidate our tight gas portfolio, divest from non-core positions across North America, and to invest for profitable growth,” said Peter Voser, chief executive of Shell, calling the East Resources assets “the premier shale gas play in the Northeast U.S.”

Shell is getting 1.05 million acres of so-called tight gas properties in North America, in the northeastern states and the Rockies, which will make up most of the 1.3 million gas acres it is acquiring on the continent this year, and which it expects will produce 16 trillion cubic feet of gas in total." More>>>>

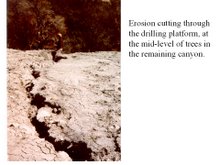

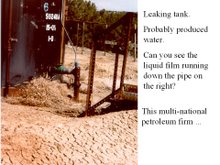

Shell is also targeting fragile ecosystems in Northern New Mexico for exploratory drilling....

No comments:

Post a Comment