"We have tight rock here with low-pressure reserves (in the San Juan Basin)," he said. "Directional drilling adds 30 to 80 percent additional costs to a well,"' the Daily Times.

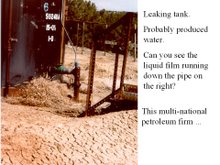

Yet, industry is whining about regulations that help mitigate damage to the environment, such as the Oil Conservation Division's "Pit Rule," which was adopted to reduce groundwater contamination from oil and gas drilling. Not only is industry in denial about pollution, it is clamoring for more deregulation.

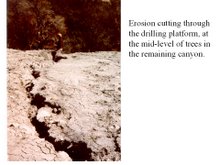

Peak oil and peak natural gas have ushered in an era of unconventional extraction that requires horizontal drilling and hydraulic fracturing. Such extraction can be more destructive and environmentally damaging than conventional techniques. The reserves that can be conventionally extracted are rapidly depleting.

Industry is complaining that drilling permit applications are down in the San Juan Basin. Their solution, to deregulate -- a defacto subsidy. As with the finance industry, the oil and gas industry must be held accountable. If drilling permit applications are down due to the higher costs of unconventional extraction, lower futures prices that quell speculative appetities, and responsible regulations, then the market has spoken. It is time to move to clean, renewable energy -- now.

No comments:

Post a Comment